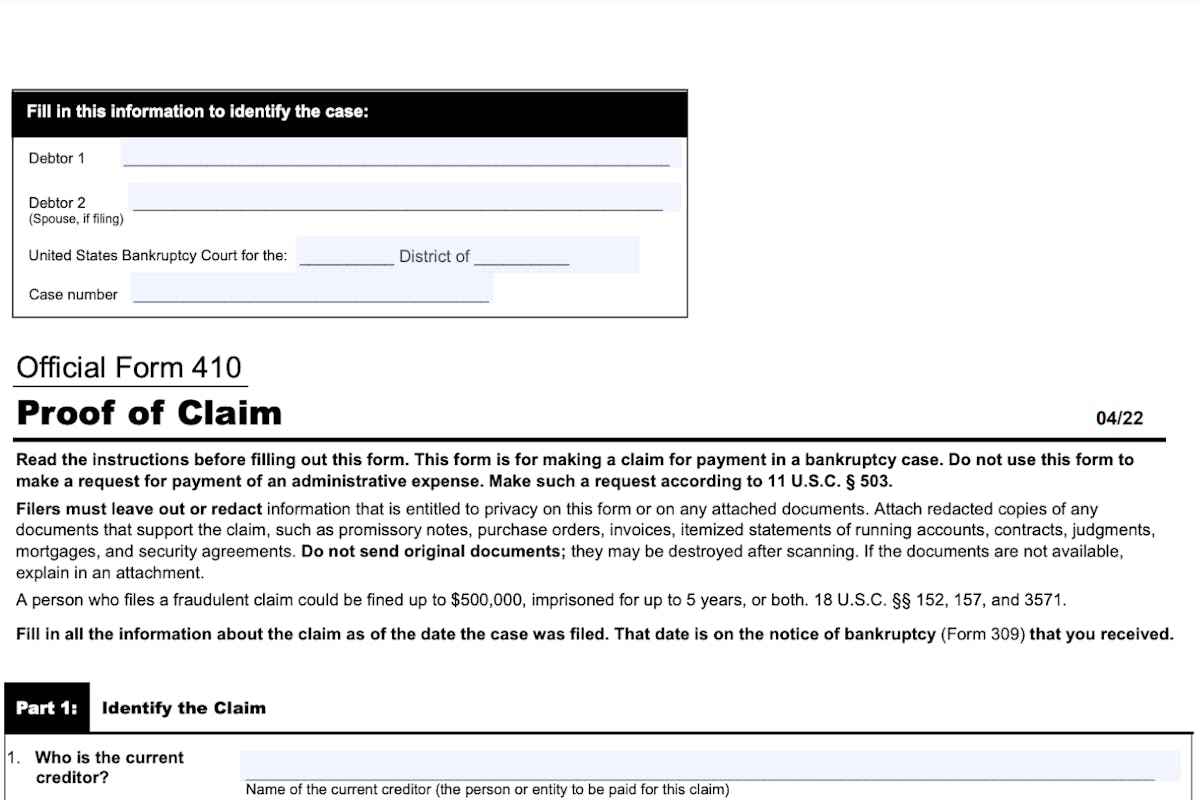

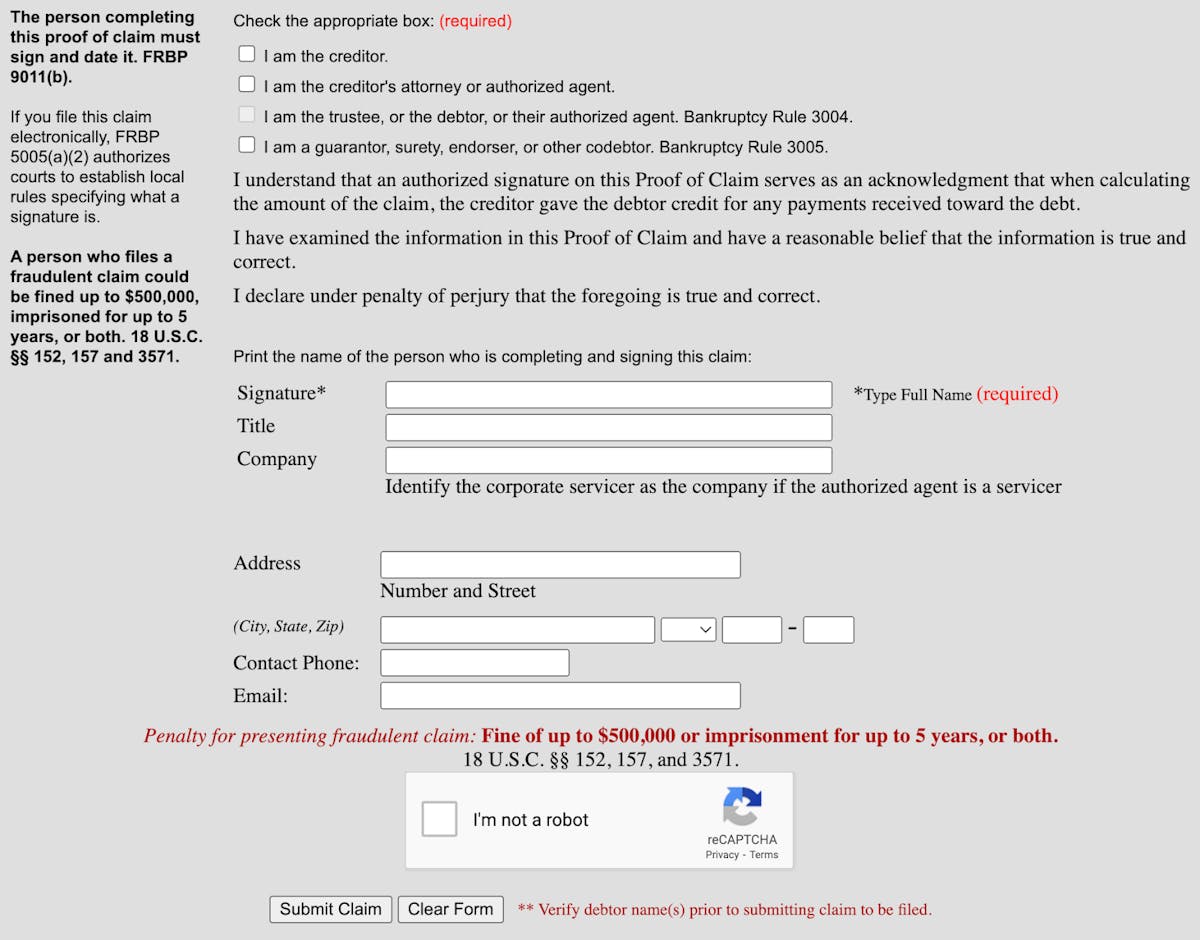

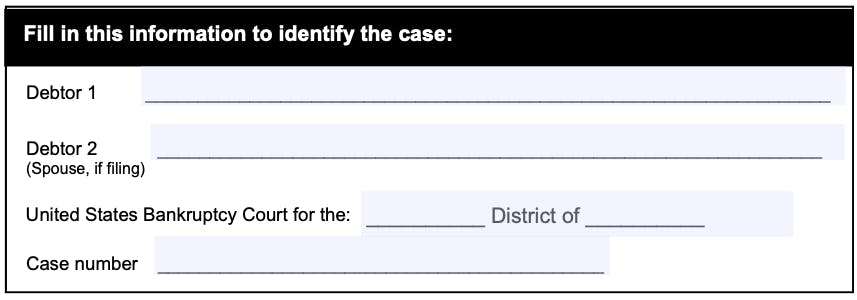

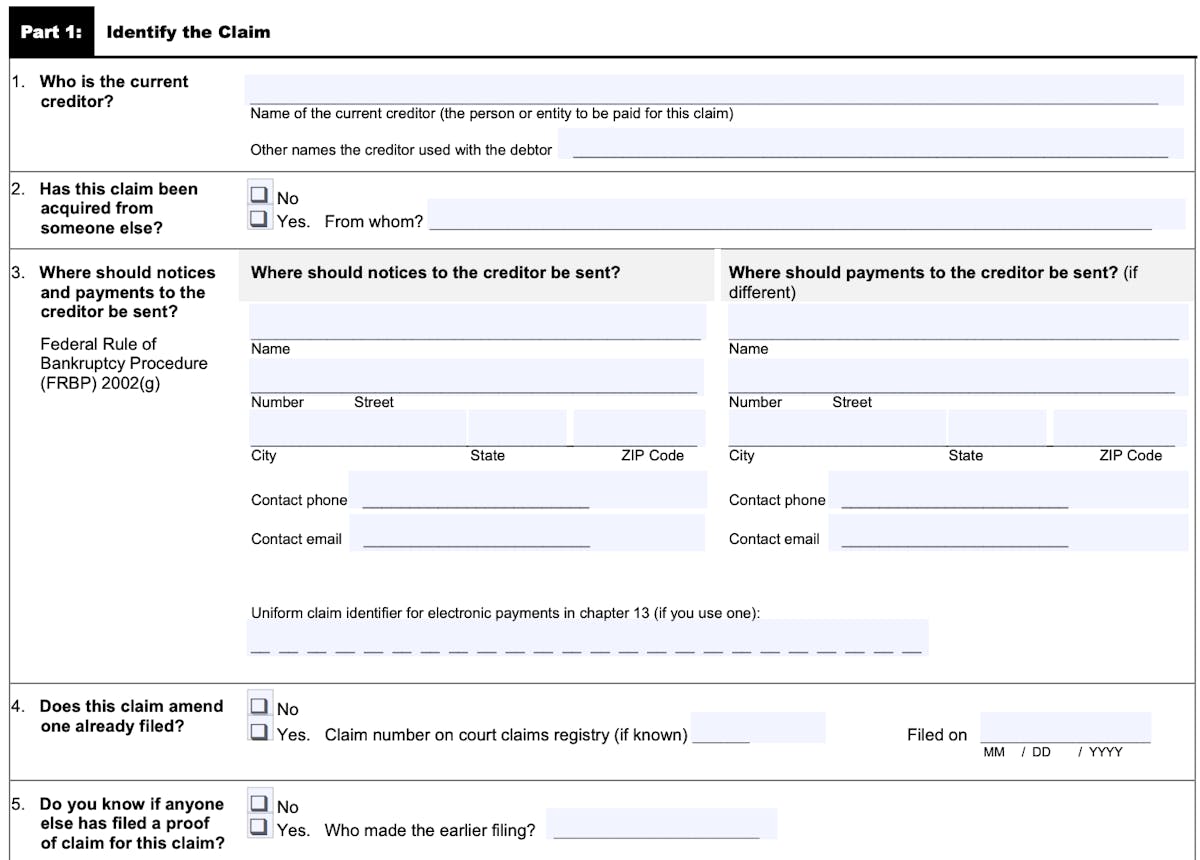

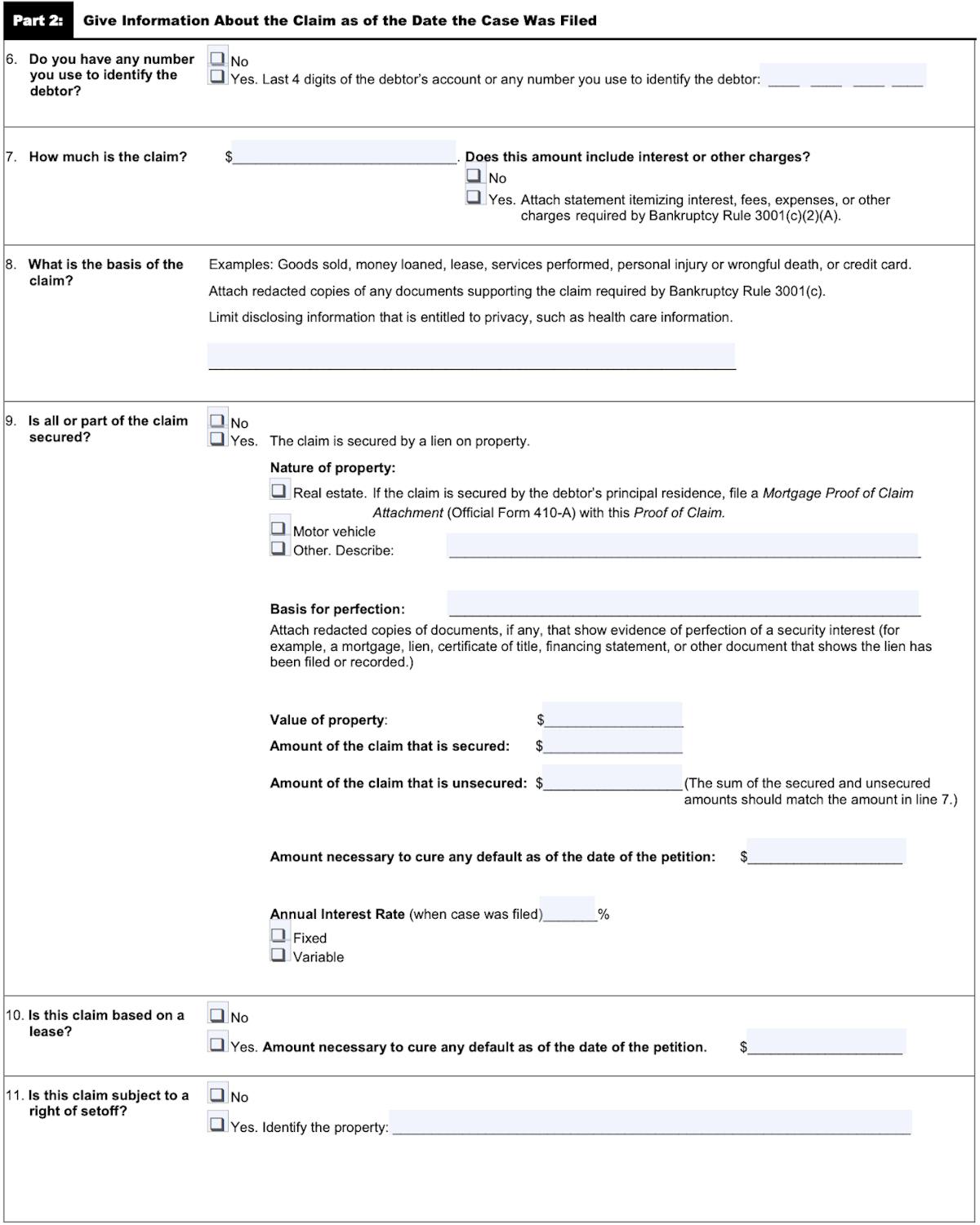

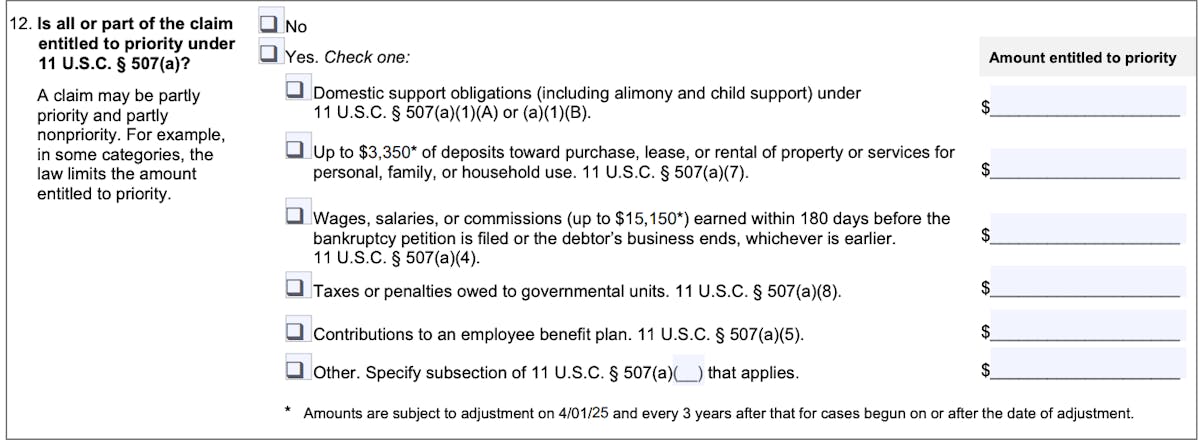

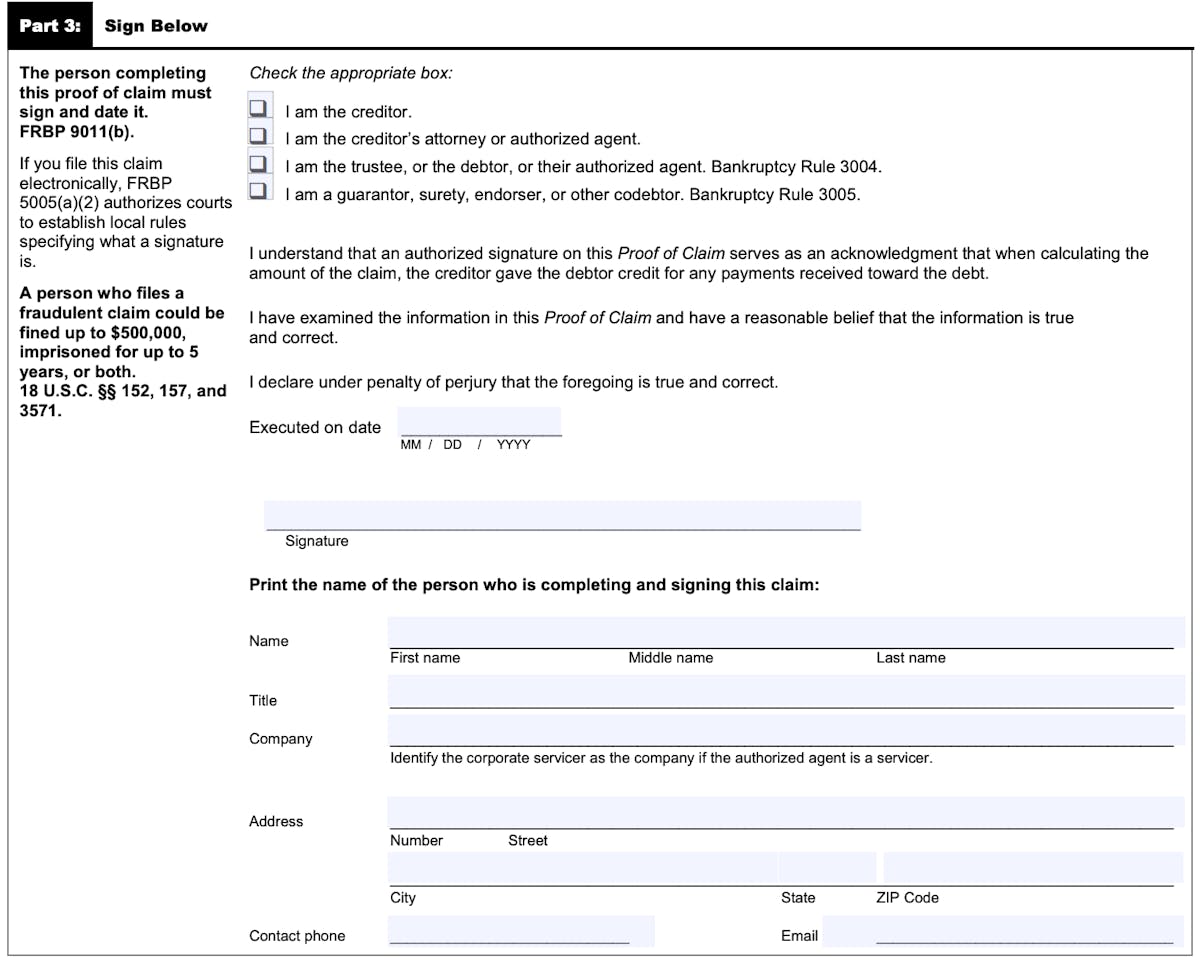

Explore the full proof of claim form here.

ePOC vs CM/ECF Proof of Claims

There are two common ways to file Proof of Claims online: through the CM/ECF filing system or through the newer Electronic Proof of Claims (ePOC) system. The official CM/ECF method is the traditional method of e-filing claims, but many districts have implemented ePOC to streamline the process. Here’s a summary of both:

Traditional CM/ECF Claims

In order to use the CM/ECF filing system, the creditor must create a PACER account, obtain filing privileges in the district, fill out the proof of claim form, attach relevant documents, and submit all of the resulting documents through the CM/ECF district filing form. Creditors can follow this method to file claims in any district.

Requesting filing privileges is the first hurdle creditors must overcome. We break down the process of requesting filing privileges in a blog article, but there are 94 different bankruptcy districts, so we generally recommend using the ePOC system for the districts that support it.

Electronic Claims Filing (ePOC)

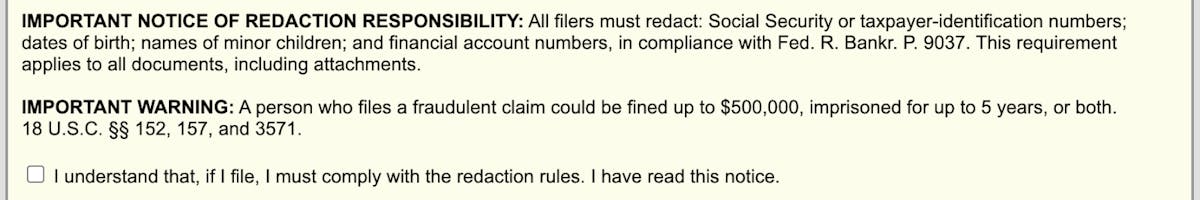

Most district courts have embraced the newer electronic filing system. Our article outlining the process of requesting filing privileges is kept up-to-date with the districts that support ePOCs. Creditors can file Proof of Claims using the district ePOC form without a PACER account or filing privileges. The ePOC web form helps creditors locate the case and lets creditors fill in the claim details through the website. Once submitted, the system populates a Proof of Claim (Official form 410) document with the information and adds it to the case.

Some districts put a limit on the number of ePOC submissions they will receive in a day, so high-volume filers often choose to file through the CM/ECF filing system. A couple of districts don’t support ePOC, so we recommend using the ePOC process when possible, and the traditional CM/ECF claims filing for the rest of the districts.

The whole process can be frustrating–we voiced the top 11 frustrations about claims filing that we’ve heard in our blog. Our API simplifies and automates the whole process. Our interface streamlines the process and let’s you file claims through ePOC and the traditional CM/ECF system in any court using one form. Schedule a demo to learn more.