Loan Acquisitions

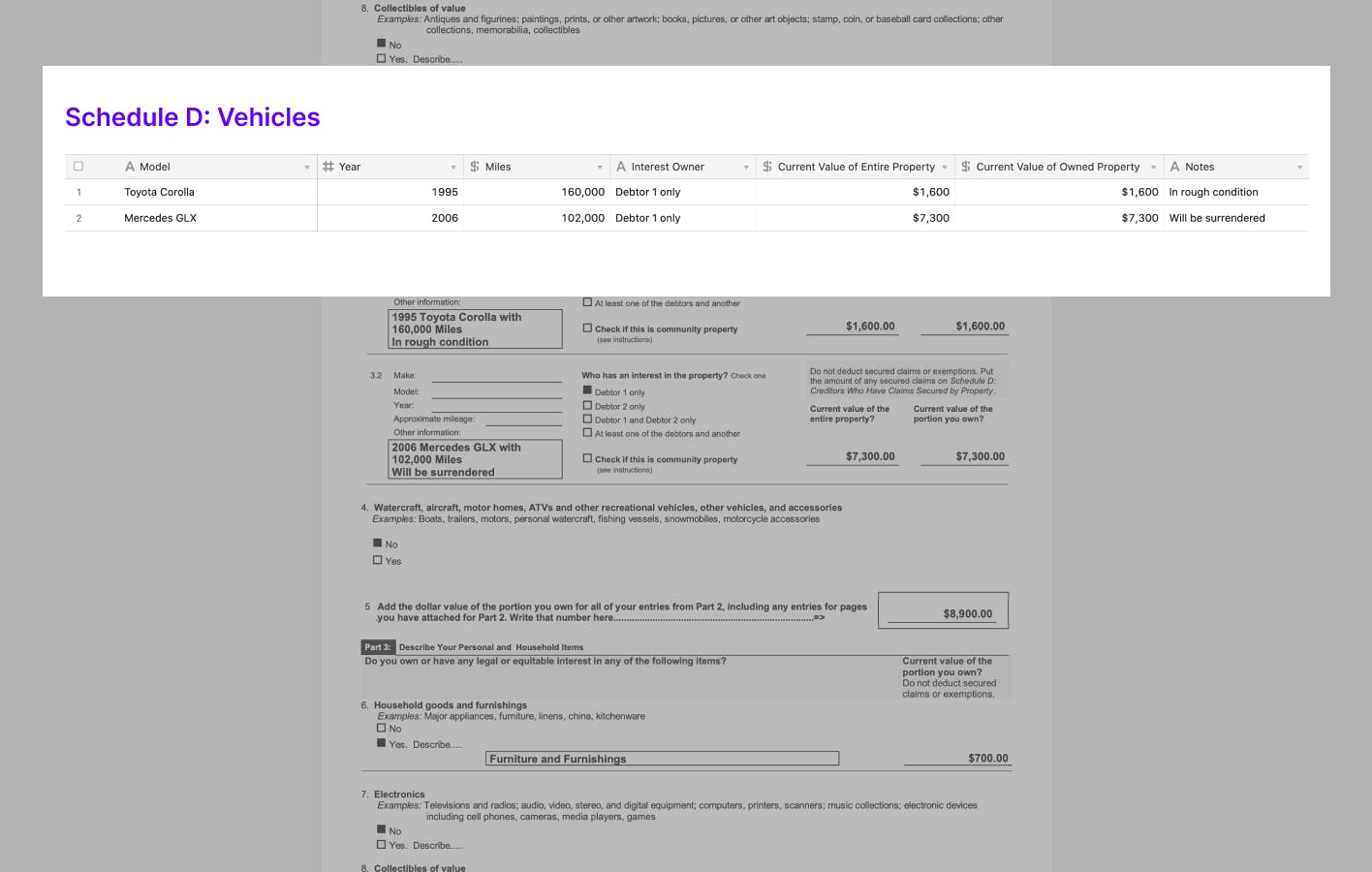

Quickly scrub loans and research relevant bankruptcy events before or right after acquiring the portfolio.

Benefits

Scale Instantly

Whether your organization is among the largest financial institutions or if you are a local bankruptcy firm, we can help you manage your bankruptcy filings. Our bankruptcy response product allows you to expand into filing bankruptcy documents without the added staffing and training hurdles experienced by others in the past.

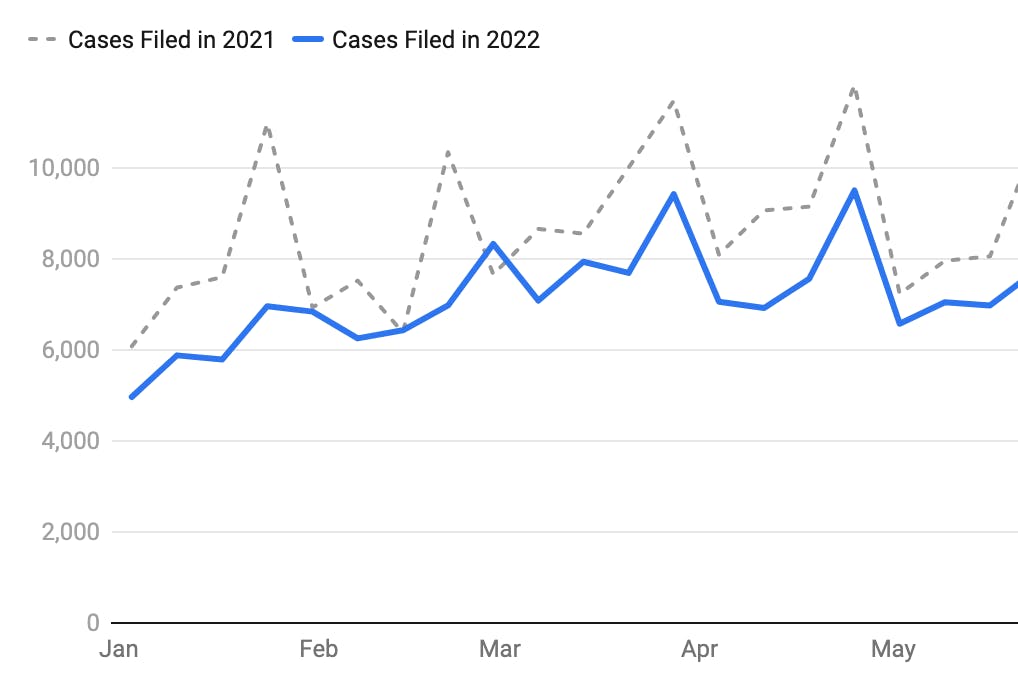

Accurate Data

Our system interacts directly with the PACER court system. This means you get exactly the data the court sees, parsed through our custom PACER mining tools, and validated through custom machine learning models.

Smart Notifications

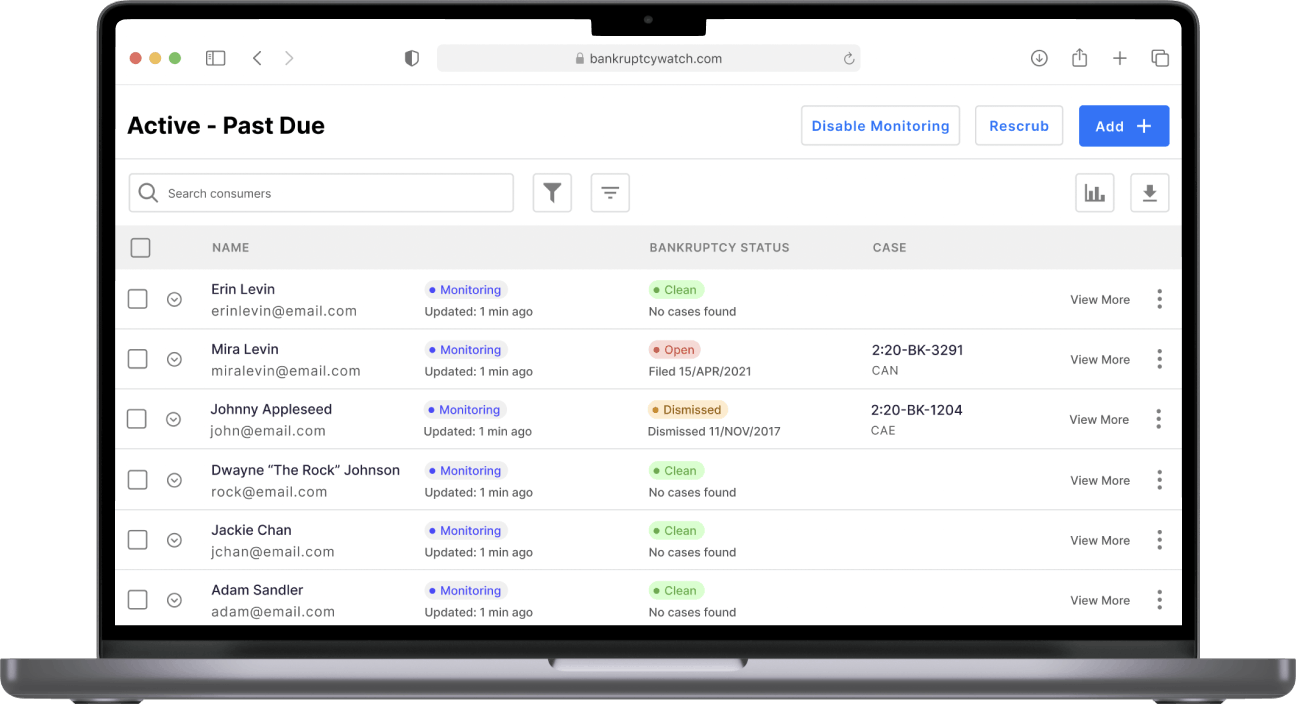

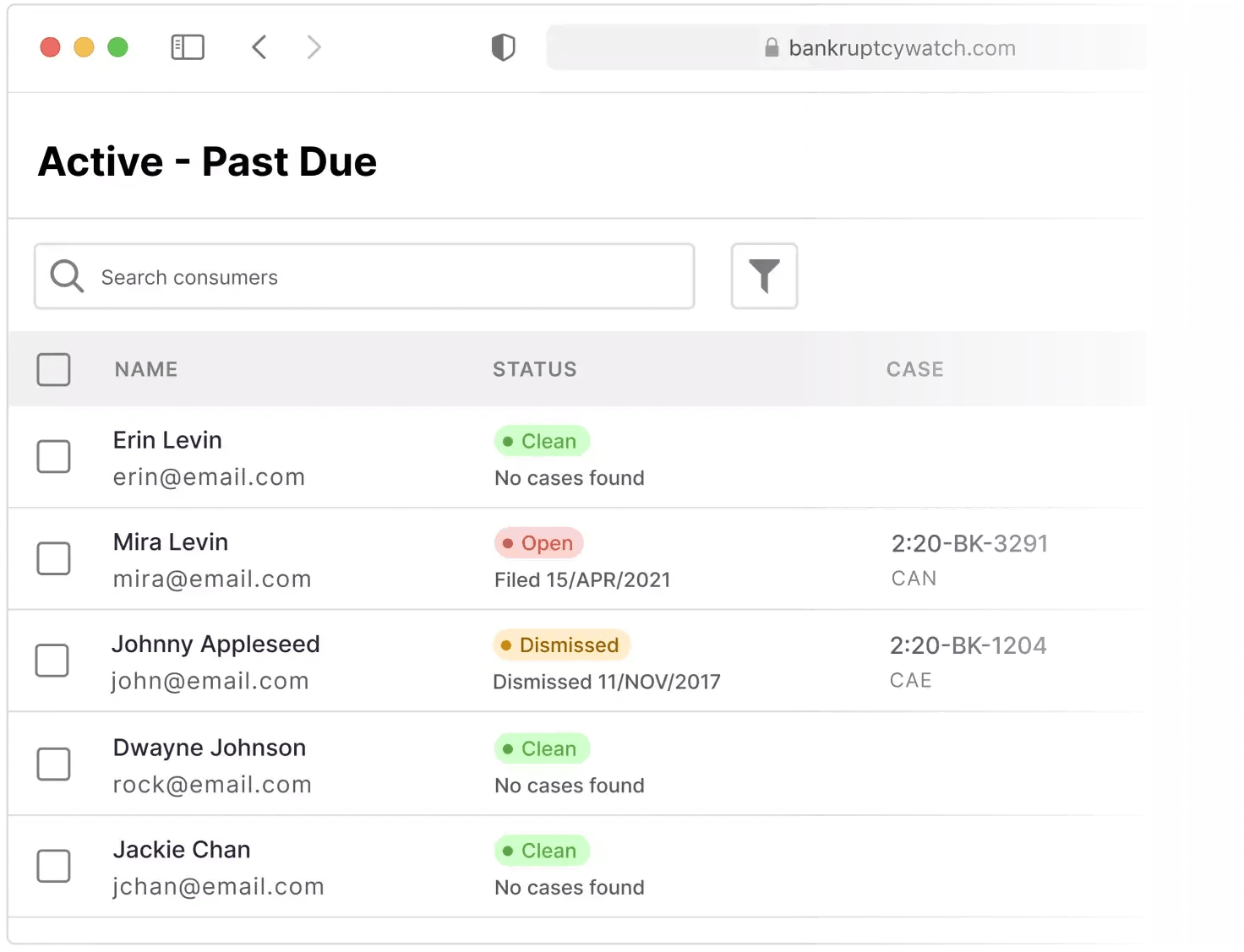

Reduce risk with instant case updates even if you haven't owned the loan long enough to be listed in a case. Our notifications use advanced matching tools to catch any relevant bankruptcy case and put you in control of what happens.

Scrub Bankruptcy Information in Minutes

Loan acquisition tools are available through the platform, integrations, no-code tools, and our API.