Automating and optimizing a bankruptcy process is hard. We’ve seen hundreds of companies approach the problem in different ways. A common factor in the most successful systems we’ve seen is adopting a data-driven strategy.

Companies that use a data-driven approach to bankruptcies are able to identify areas of opportunity and iterate approaches.

Let’s walk through an example of using data to inform dismissal processing.

The data behind dismissals

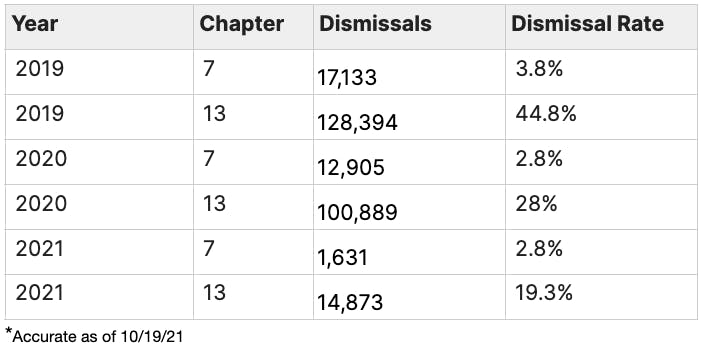

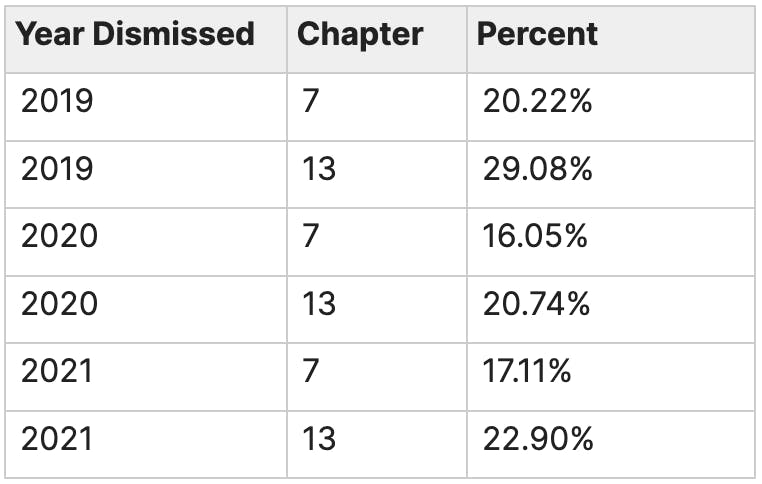

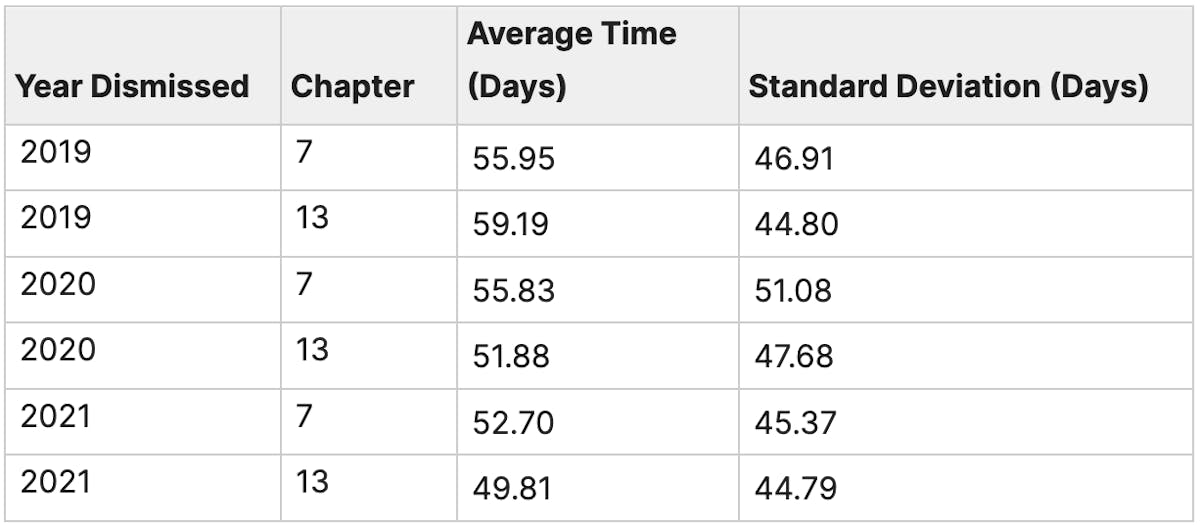

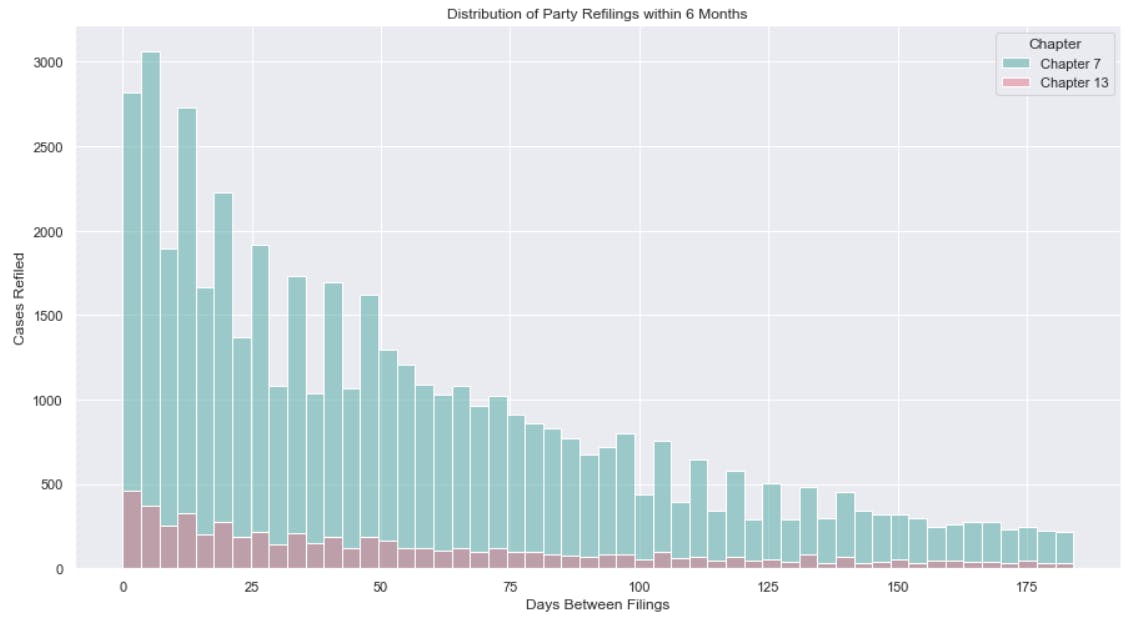

We pulled dismissal data focusing on cases dismissed between 2019-02-22 and 2021-03-01. Here is the breakdown of dismissals: