Loan Servicing

Our complete bankruptcy loan servicing tools make it super easy to manage bankrupt accounts.

Benefits

Scale Instantly

Whether your organization is among the largest financial institutions or if you are a local collection agency, we can help you manage your bankruptcy portfolio. Our products allow you to expand your reach into the bankruptcy space without the added staffing and training hurdles you would normally expect.

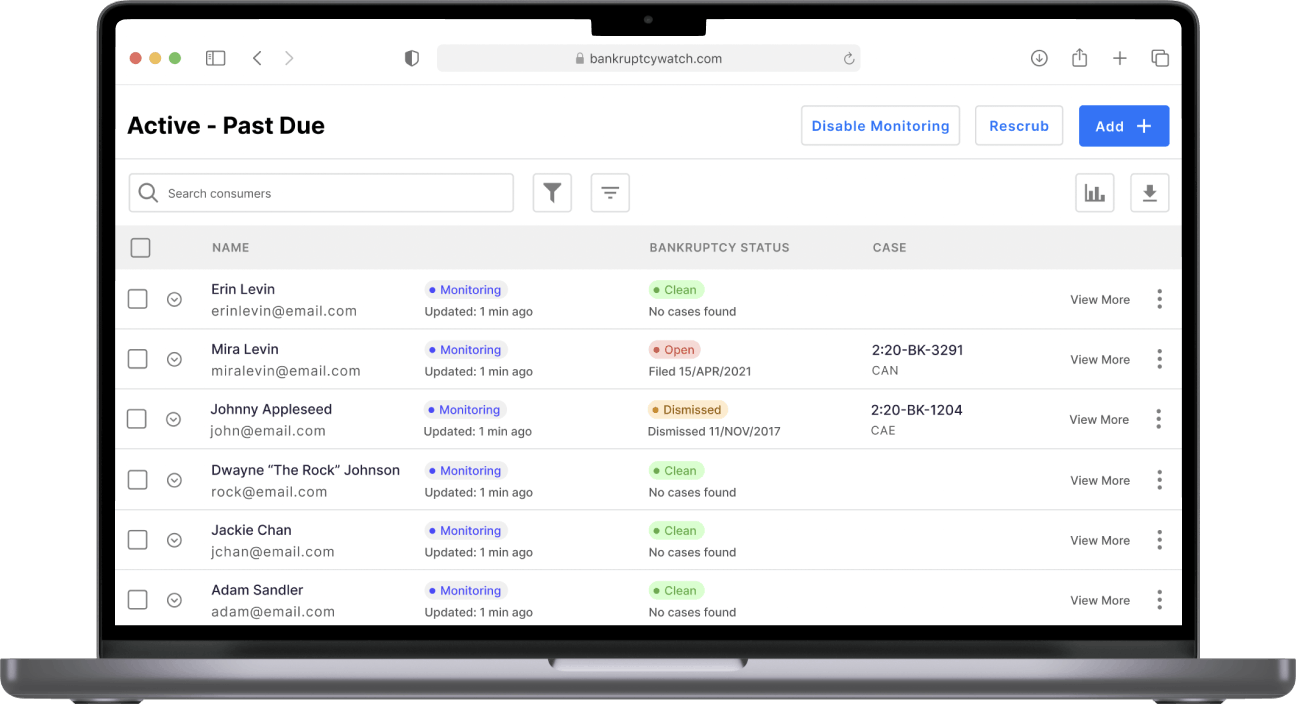

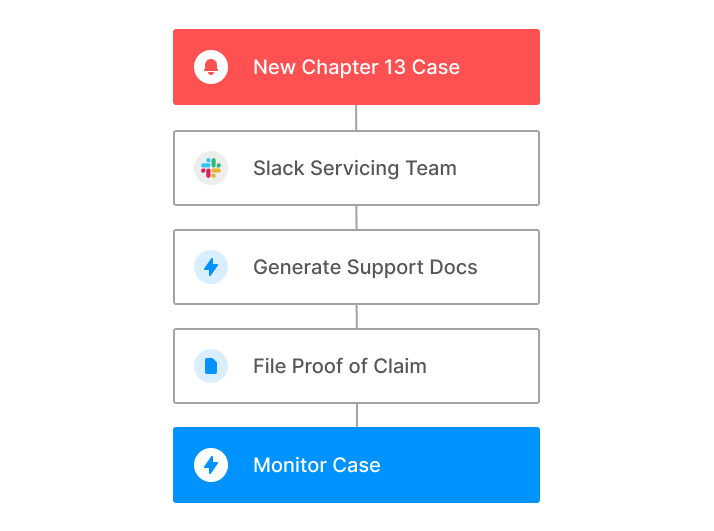

More than Just Monitoring

Detect, import, parse, research, and respond to any case event that affects you. Everything you need to generate a response, file documents, and update accounts is available through our toolset.

End-to-End Reliability

Rest easy knowing we use cutting-edge cloud architecture to maintain the end-to-end uptime for our services. Additionally, we operate PacerUpTime.com to provide availability information and bug reports for all 94 US Bankruptcy Courts.

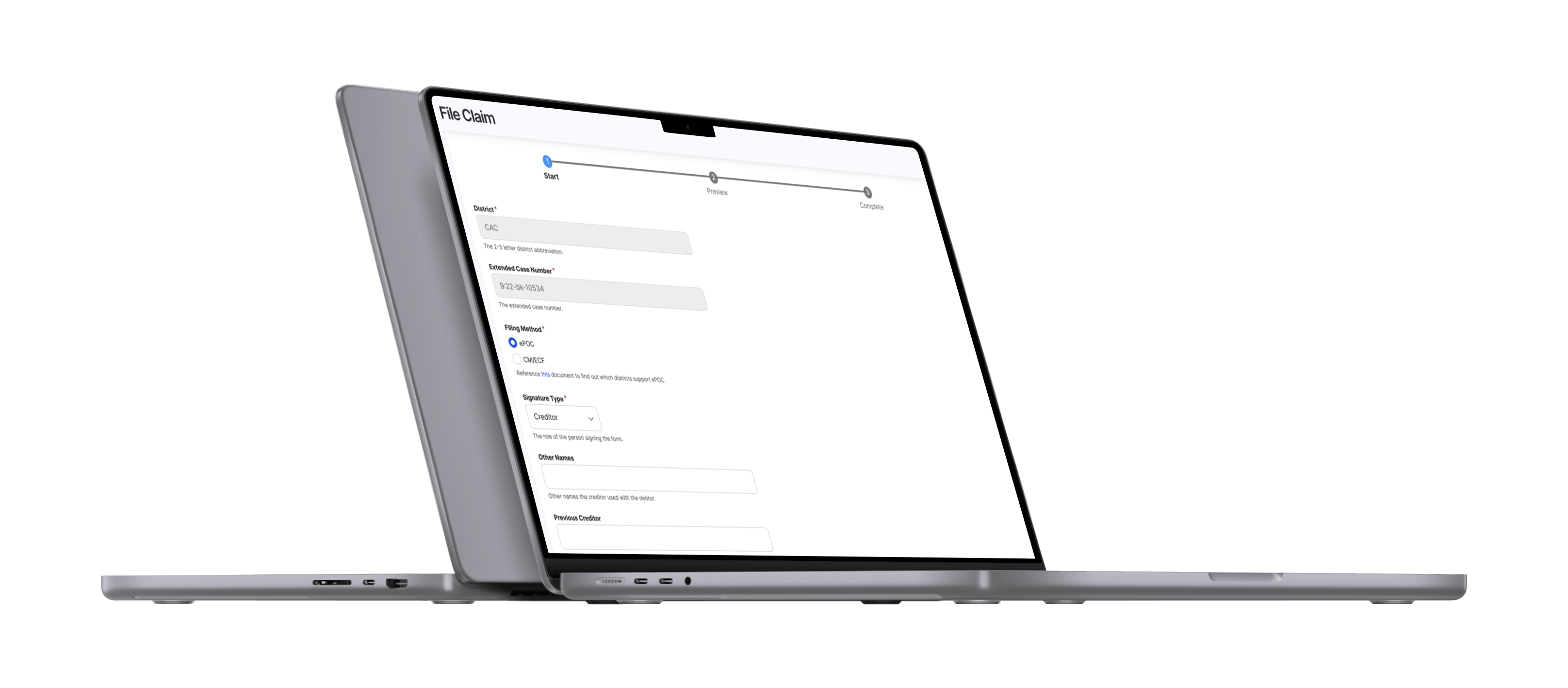

Start Servicing Bankruptcies in Minutes

Loan servicing tools are readily available through the platform, integrations, no-code tools, and our API.