Introduction

Filing for bankruptcy can be a complex and daunting process, both for debtors seeking financial relief and creditors looking to protect their interests. One critical step for creditors is filing a proof of claim, which allows them to assert their right to a share of the debtor's available assets. In this article, we'll break down the steps involved in filing a bankruptcy proof of claim, referencing relevant sections of the Bankruptcy Code and Bankruptcy Rule to provide a clear and comprehensive guide.

Understanding the Basics

When a debtor files for bankruptcy, it initiates a legal proceeding where creditors are required to submit their claims to the bankruptcy court. This ensures that the debtor's assets are distributed fairly among all eligible creditors. The process is governed by the United States Bankruptcy Code, Title 11 of the United States Code, and the Federal Rules of Bankruptcy Procedure.

What is a Claim?

"Claim" in bankruptcy is defined as: (A) a right to payment, whether or not reduced to judgment, liquidated, unliquidated, fixed, contingent, matured, unmatured, disputed, undisputed, legal, equitable, secured or unsecured; or (B) a right to an equitable remedy for breach of performance if such breach gives rise to a right to payment, whether or not such right to an equitable remedy is reduced to judgment, fixed, contingent, matured, unmatured, disputed, undisputed, legal, equitable, secured or unsecured.

Reference:

- Bankruptcy Code Section 101(5) defines a claim.

Identifying Relevant Information

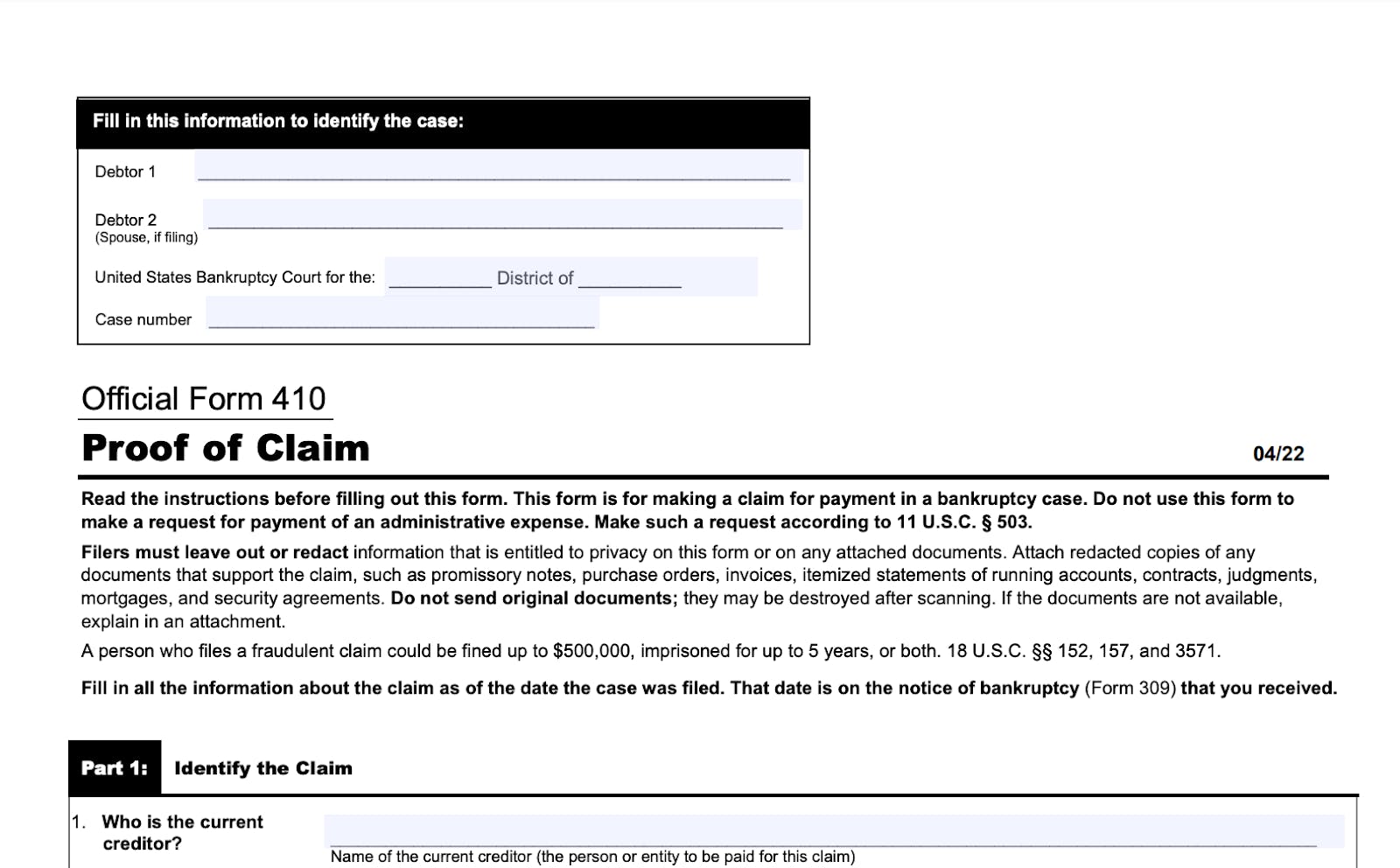

Before you begin the process of filing a proof of claim, it's essential to gather all relevant information. This includes the debtor's name, case number, and the type of bankruptcy proceeding (Chapter 7, Chapter 11, Chapter 13, etc.). You should also have documentation to support your claim, such as invoices, contracts, promissory notes, or other evidence of the debt owed.

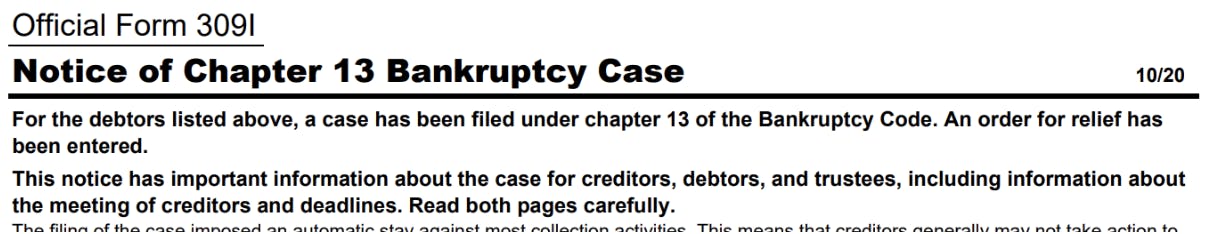

Identify and Calendar the Deadline to File the Claim

The deadline for filing a claim in a Chapter 7, 12 or 13 is 70 days from the date the bankruptcy is filed. This date is also identified in the Notice of the bankruptcy case. For example, in a Chapter 13 bankruptcy, the Notice of Chapter 13 Bankruptcy Case will include the date for filing claims. The Notice is captioned like this: