Filing a mortgage proof of claim in bankruptcy proceedings in the United States can be a complex process. This guide aims to walk mortgage lenders and other interested parties through the steps and considerations involved. Key citations to the U.S. Bankruptcy Code, the Federal Rules of Bankruptcy Procedure, and official bankruptcy forms are provided for clarity and guidance.

Introduction

When a debtor files for bankruptcy, creditors need to file a proof of claim to assert their rights to a share of the debtor's assets or future earnings. Filing a mortgage proof of claim involves specific procedures, governed by federal bankruptcy laws and local court rules. A proof of claim is essentially a formal declaration by a creditor stating the reason the debtor owes money.

To determine how your mortgage lien may be treated throughout a bankruptcy it is important to identify the legal classification of the lien. This knowledge is very important when drafting and filing a proof of claim and so it is included below before discussing how to prepare and file a proof of claim.

Types of Mortgage Liens

1. Purchase Money Security Interests (PMSI)

A Purchase Money Security Interest is a form of lien that lenders secure when providing funds to purchase an asset. In the context of real estate, a PMSI typically takes the form of a mortgage that is used to buy the property.

Characteristics

- Voluntary: PMSI arises from a contractual agreement between the lender and the borrower. The borrower willingly agrees to put up the property as collateral.

- Specifically Defined: These liens are usually well-defined in terms of the property they cover, the duration, and the conditions under which they can be enforced.

- Priority: One unique feature of a PMSI is that it often has priority over other types of liens, as it's directly associated with the acquisition of the property.

Legal Framework

The concept of PMSI is particularly important under the Uniform Commercial Code (UCC), though state property laws also play a critical role. Always consult the terms of your specific loan agreement and local laws to understand the conditions related to a PMSI.

2. Non-PMSI

A Non-PMSI, on the other hand, refers to any lien or mortgage that is not directly involved in purchasing the property. These loans might include home equity lines of credit, second mortgages taken out for reasons other than the property’s purchase, or any other lien that attaches to the property post-acquisition.

3. Judicial Liens

Judicial liens come into existence as the result of a court judgment. If a property owner is sued and loses, the court may place a lien on the property as a means to secure payment for the judgment.

Characteristics

- Involuntary: Unlike a PMSI, judicial liens are not created through mutual agreement but are imposed by a court of law.

- Non-Specific: Judicial liens do not necessarily have to be tied to the property that is the subject of the lawsuit; they can be attached to any property owned by the judgment debtor.

- Enforceability: These liens usually result in forced sale of the property (foreclosure) if the judgment is not paid within a certain timeframe.

Legal Framework

The Federal Rules of Civil Procedure and corresponding state laws define the processes by which judicial liens can be established and executed. The process generally starts with a judgment, followed by the issuance of a writ of execution, and culminates in the placement of a lien on property identified by the judgment creditor.

4. Statutory Liens

Statutory liens are established by statutes, or laws, rather than by a contract or judicial action. Common examples include tax liens, mechanic’s liens, and homeowner’s association (HOA) liens.

Characteristics

- Automatic: Statutory liens generally attach automatically when certain conditions defined by law are met.

- Involuntary: Like judicial liens, they are not based on a consensual contract.

- Limited Scope: Statutory liens are often limited to specific types of property or specific circumstances.

Legal Framework

Statutory liens are created by federal or state statutes. For example, tax liens are governed by federal law and are placed automatically when a taxpayer fails to pay their federal taxes.

Potential Effect of Bankruptcy On Mortgage Liens

Treatment in Chapter 7 Bankruptcy

In a Chapter 7 bankruptcy, the debtor's assets may be liquidated to pay off unsecured debts. While the automatic stay prevents immediate foreclosure, the mortgage lien is not extinguished unless specific action is taken to void the lien. Once the bankruptcy case is closed, the property securing the lien is abandoned by the chapter 7 trustee, and the automatic stay is lifted, the creditor is free to pursue foreclosure if the debtor has not made good on their mortgage payments (See 11 U.S.C. § 362(c)).

If the lien is not voided in the Chapter 7 bankruptcy, the discharge does not deprive a mortgagee of its right to collect its debt in rem. 11 U.S.C. § 524(a)(2) (2023) ("A discharge . . . operates as an injunction against the commencement or continuation of an action, the employment of process, or an act, to collect, recover or offset any such debt as a personal liability of the debtor.") (emphasis added); Johnson v. Home State Bank, 501 U.S. 78, 84, 111 S. Ct. 2150, 115 L. Ed. 2d 66 (1991) ("[A] bankruptcy discharge extinguishes only one mode of enforcing a claim—namely, an action against the debtor in personam—while leaving intact another—namely, an action against the debtor in rem."). Instead, "a creditor's right to foreclose on the mortgage survives or passes through the bankruptcy." Johnson, 501 U.S. at 83.

1. Purchase Money Security Interests (PMSI)

- Priority: These liens usually have priority over other types of liens.

- Protection: Under 11 U.S.C. § 522(f), it is usually not possible to "avoid" a PMSI in Chapter 7.

- Options: Debtors usually must continue making payments if they want to keep the property, or they may choose to surrender the property.

2. Non-PMSI

- Subordination: They usually take a back seat to PMSIs.

- Cramdowns and Strip-Downs: Not typically available in Chapter 7 (but can be more prevalent in Chapter 13).

- Surrender or Reaffirmation: Options include surrendering the property or reaffirming the debt to keep the property.

3. Judicial Liens

- Avoidance: Under 11 U.S.C. § 522(f), debtors can often move to "avoid" judicial liens to the extent that they impair an allowed exemption.

- Dischargeability: The underlying debt may be dischargeable, but the lien remains until actively avoided.

4. Statutory Liens

- Variability: Treatment can vary widely depending on the type of statutory lien and the relevant state and federal laws.

- Survival: Some statutory liens, like certain tax liens, can survive bankruptcy and still need to be paid.

Treatment in Chapter 13 Bankruptcy

Legal Framework

Critical sections of the U.S. Bankruptcy Code for Chapter 13 cases are:

- 11 U.S.C. § 1322: This outlines the requirements for a Chapter 13 plan, including the treatment of secured claims.

- 11 U.S.C. § 1325: This describes the conditions under which a Chapter 13 plan may be confirmed.

1. Purchase Money Security Interests (PMSI)

- Anti-Modification Clause: Per 11 U.S.C. § 1322(b)(2), PMSIs on a debtor’s principal residence generally cannot be modified ("crammed down") in Chapter 13.

- Exceptions to the Anti-Modification Clause

undefinedundefined

- Arrearages: Debtors can catch up on missed mortgage payments over the life of the Chapter 13 plan. See 11 U.S.C. § 1322(b)(5).

2. Non-PMSI

- Cramdown or Avoidance Similar to PMSIs, Non-PMSIs are more commonly subject to the exceptions to the anti-modification provision discussed above.

- Arrearages: Debtors can catch up on missed mortgage payments over the life of the Chapter 13 plan. See 11 U.S.C. § 1322(b)(5).

3. Judicial Liens

- Lien Stripping: Under 11 U.S.C. § 1322(b), judicial liens can often be stripped off if they impair an exemption.

- Dischargeability: Once stripped, the underlying debt can often be discharged.

4. Statutory Liens

- Variability: Treatment varies widely depending on the statute under which the lien was created.

- Priority Payment: Certain statutory liens, like tax liens, often must be paid in full through the Chapter 13 plan.

Preparing and Filing the Proof of Claim

A "proof of claim" is a written statement setting forth a creditor's claim. A claim is a right to payment, either fixed, unliquidated, secured, or unsecured (11 U.S.C. § 101(5)).

Importance of Filing a Proof of Claim

The Bankruptcy Code stipulates that failing to file a proof of claim may result in the creditor's claim not being allowed, thereby forfeiting the creditor's rights to any distribution in the bankruptcy case (11 U.S.C. § 502).

Automatic Stay

Upon the debtor filing for bankruptcy, an "automatic stay" is usually imposed under 11 U.S.C. § 362. The automatic stay prevents most creditors from taking collection actions against the debtor. While the stay is in effect, creditors must assert their claims within the bankruptcy process itself.

Timeframe for Filing a Proof of Claim

The deadline for filing a proof of claim varies depending on the type of bankruptcy case, but it is generally 70 days after the bankruptcy filing date for non-governmental creditors. This deadline may be subject to extension under specific conditions (Federal Rule of Bankruptcy Procedure 3002(c)).

Step-by-Step Guide to Filing a Mortgage Proof of Claim

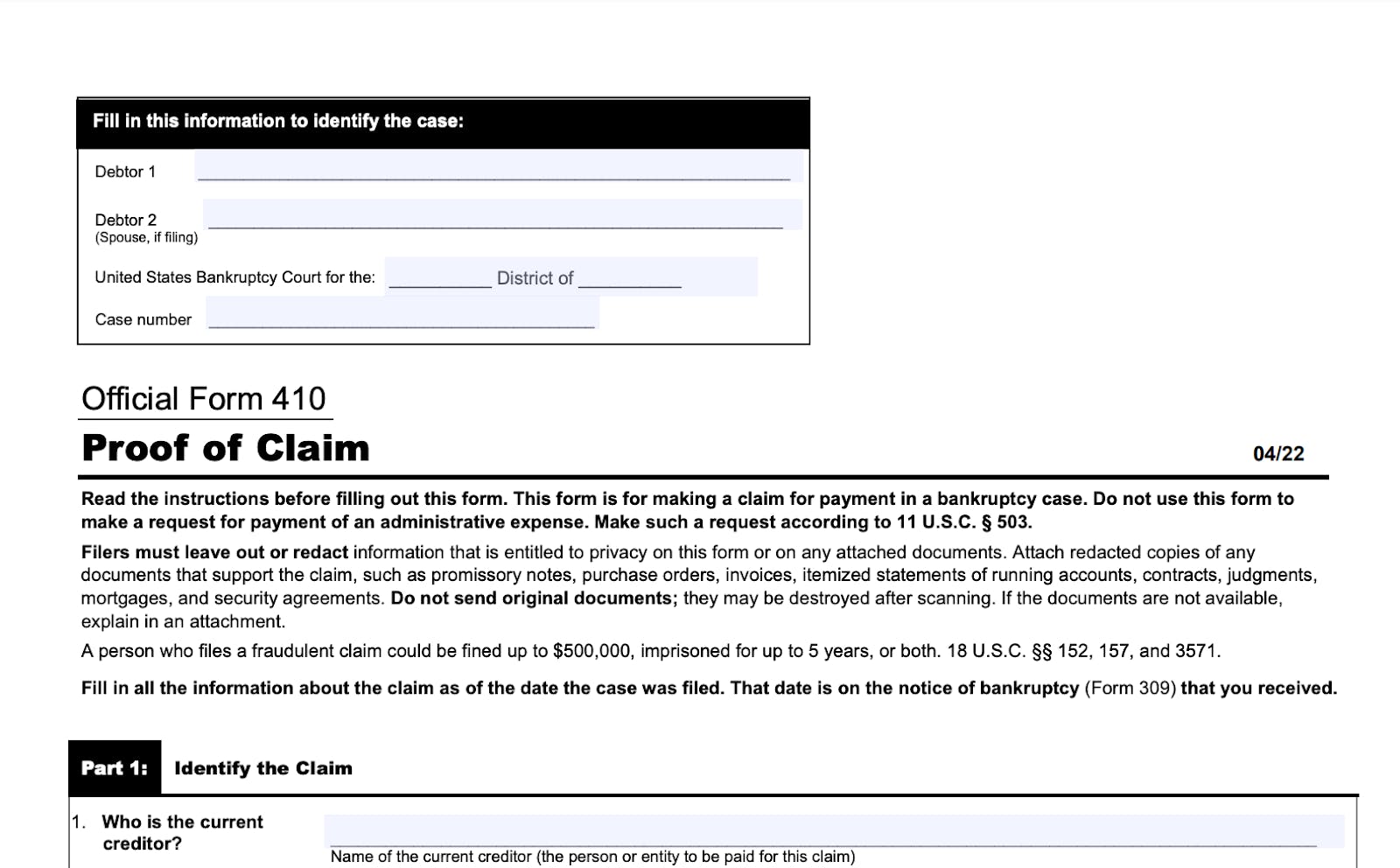

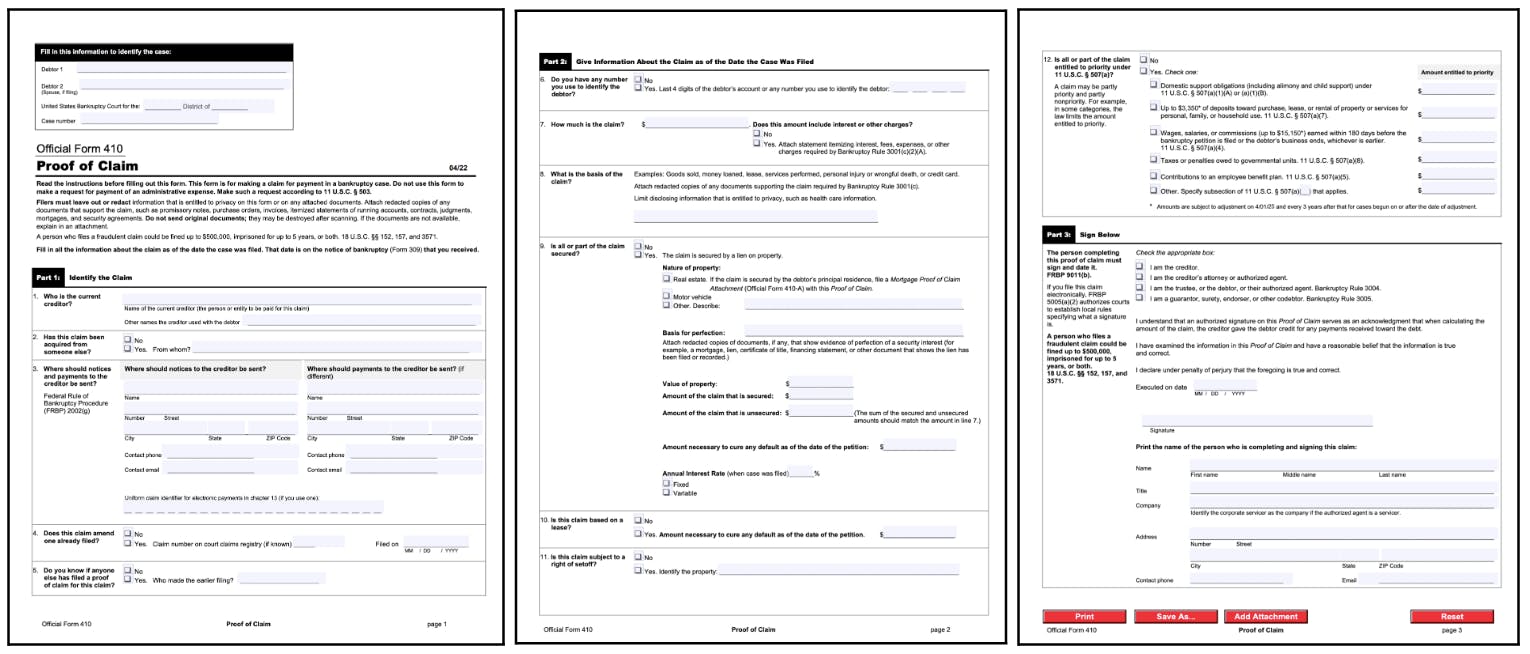

Step 1: Acquaint Yourself With Applicable Forms

- Official Bankruptcy Form 410: Form 410 is the official form used to file a proof of claim. This form requires you to provide information about the debtor, creditor, and the claim itself.

- Form 410A: For creditors with a mortgage claim, Form 410A (Mortgage Proof of Claim Attachment) serves as an additional, necessary attachment. This form provides more detailed information specific to mortgage claims.

Step 2: Complete Official Bankruptcy Form 410

Form 410 requires the following details:

- Name of Debtor: Usually the individual or entity that has filed for bankruptcy.

- Case Number: This is assigned by the bankruptcy court and is crucial for document tracking.

- Name of Creditor: This is where you list the name of the lender or entity asserting the mortgage claim.

- Mailing Address: The address where any correspondence related to the claim should be sent.

- Amount of Claim: Here, you'll specify the amount owed as of the bankruptcy filing date.

- Basis for Claim: This is where you'll specify that the claim is based on a mortgage.

- Last Four Digits of Any Number: Typically, the account number or loan number tied to the mortgage, for identification purposes.

- Type of Claim: Whether the claim is secured or unsecured. A mortgage is generally a secured claim.

- Supporting Documentation: You should attach all relevant documents that support your claim, such as mortgage agreements and payment histories.

Step 3: Complete Form 410A

Form 410A requires additional mortgage-specific information:

- Principal and Interest: Breakdown of the outstanding principal and any accrued interest.

- Additional Fees: Late fees, penalties, and other charges must be itemized.

- Escrow Account: Information regarding any escrow accounts for property taxes, insurance, etc.

Step 4: Attach Required Documentation

- Mortgage Note: This is the original agreement and serves as the basis of your claim.

- Statement of Account: This is an itemized statement showing the calculation of the claim amount.

- Evidence of Perfected Security Interest: Documents proving that the mortgage lien is properly recorded and thus enforceable.

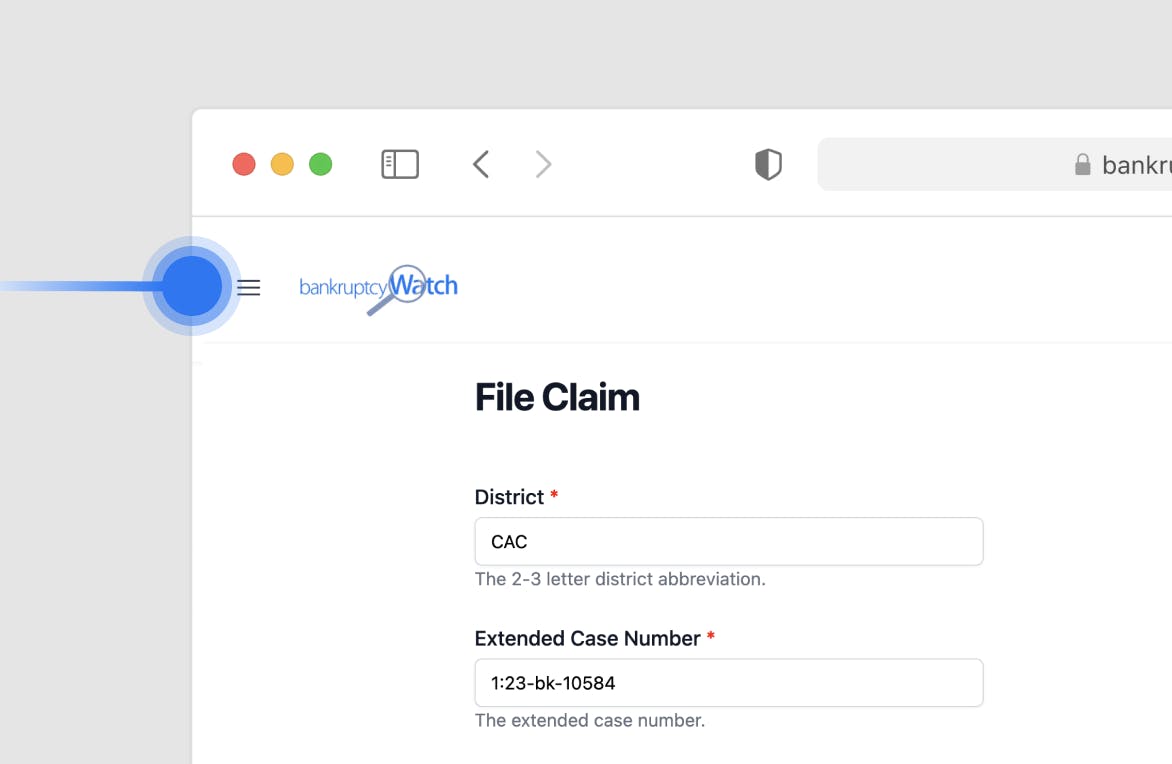

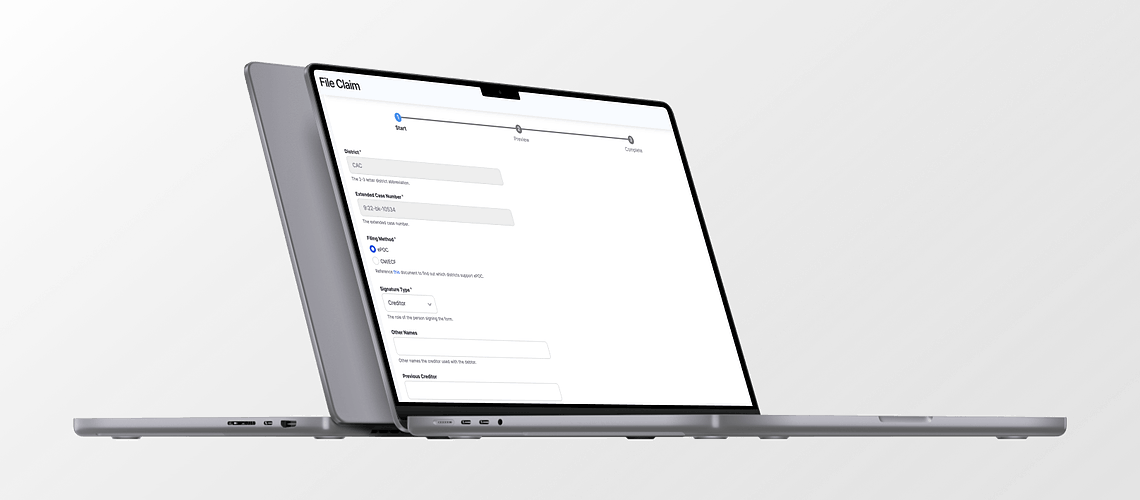

Step 5: File the Claim

Filing can usually be done in three ways:

- BankruptcyWatch: The form can be generated and filed in any district through the BankruptcyWatch website, API, and integrations.

- Via Mail: The completed form should be mailed to the bankruptcy court's clerk's office.

- Electronically: Many courts allow for electronic filing via their official portal.

Please ensure you are compliant with any local rules that may apply. Each bankruptcy court can have its own local rules that supplement the Federal Rules of Bankruptcy Procedure.

What Happens After Filing?

Objections to Your Claim

Both the debtor and the bankruptcy trustee have the right to object to your claim (11 U.S.C. §§ 502(a), 502(b)). If an objection is filed, you will receive notice and will have an opportunity to defend your claim in court.

Distributions

If your claim is allowed, you'll be entitled to receive distributions from the bankruptcy estate, subject to the priorities set forth in 11 U.S.C. § 507.

Mortgage Modifications in Bankruptcy

Debtors may sometimes seek to modify the terms of their mortgage during a bankruptcy case, which can affect your claim. Be prepared to negotiate or defend the original terms of the mortgage.

Conclusion

Filing a mortgage proof of claim in bankruptcy proceedings is a complex process governed by various laws and rules. This guide is intended to provide a comprehensive look at how to navigate this process, but it is not a substitute for legal advice. Always consult with a legal professional for advice tailored to your specific circumstances.

References

- 11 U.S.C. §§ 101(5), 362, 502, 507

- Federal Rules of Bankruptcy Procedure 3002(c)

- Official Bankruptcy Forms 410 and 410A

______________

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their attorney to obtain advice with respect to any particular legal matter. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation.