*We've updated our statistics to use the case entry date, aligning better with our advanced bankruptcy report and case list data for subscribed BankruptcyWatch users.

Our Analysis of the Bankruptcy Statistics (Updated January 26th, 2026)

Week 4 continued the upward trend, with consumer bankruptcies rising around 12% to 10,032 filings and business filings jumping about 42% to 138 cases compared with the same week last year. Chapter 7 filings, a common lifeline for struggling households, were up 9.08% year-over-year (5,659 in 2025 to 6,173 in 2026).

Chapter 13 filings, which allows individuals to restructure their debt, were up 16.34% year-over-year (3,317 in 2025 to 3,859 in 2026). Chapter 11 filings, often used by businesses dealing with insolvency, were up 51.11% year-over-year (90 in 2025 to 136 in 2026).

The 51% surge in Chapter 11 filings extends a pattern that's now held for most of January: commercial distress isn't normalizing, it's accelerating. Sectors sensitive to interest rates, freight costs, and consumer demand continue to bear the brunt, with trucking, retail, and healthcare among the most exposed.

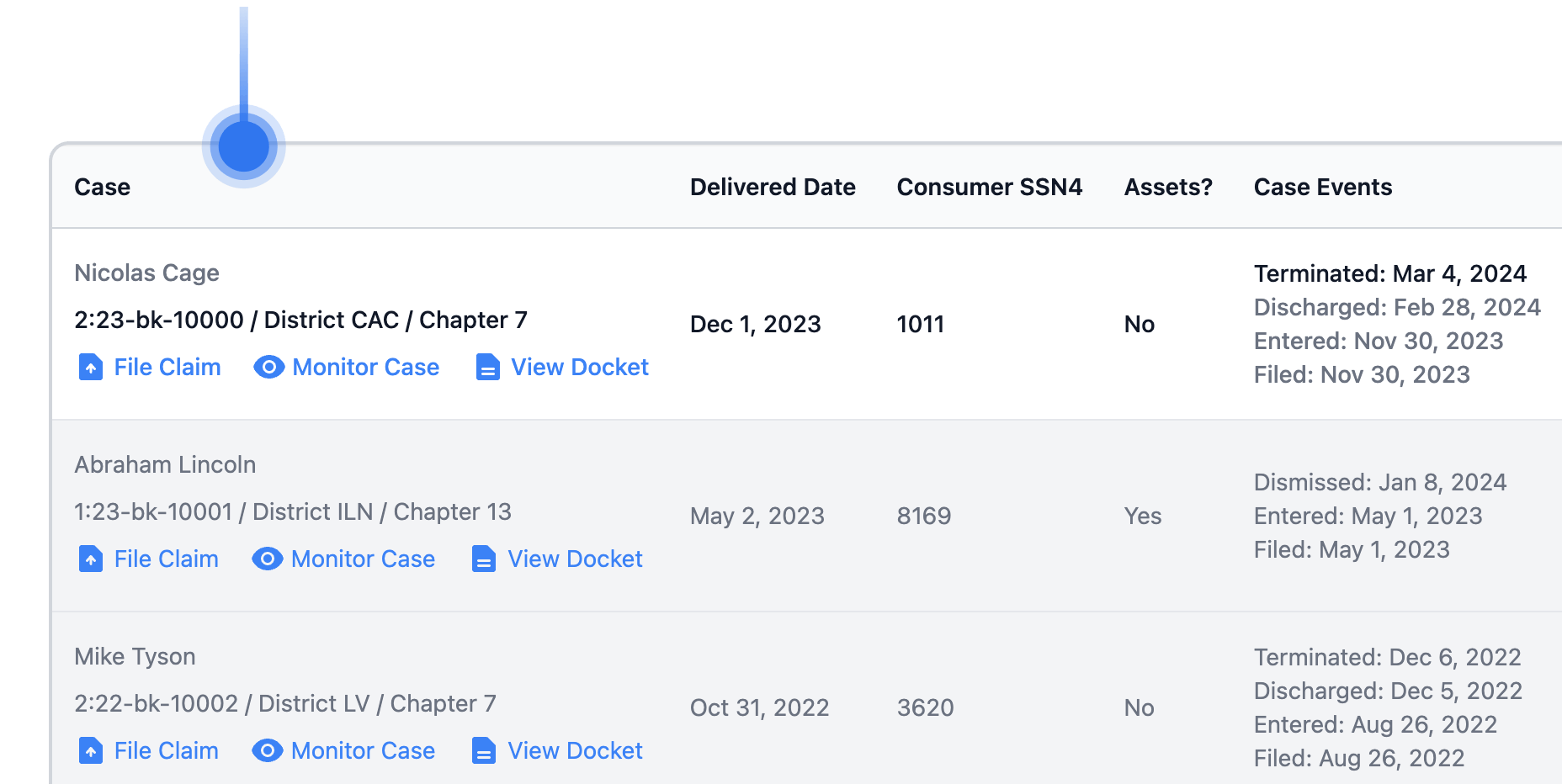

For creditors, the sustained YoY growth in business filings reinforces the need for early-warning monitoring, particularly among mid-market borrowers where refinancing options have narrowed considerably.

On the consumer side, the faster growth in Chapter 13 (+16%) versus Chapter 7 (+9%) suggests more filers still have enough income to attempt repayment plans rather than full liquidation which is a potentially positive signal for recoveries. However, with 15.3% of Americans expecting to miss debt payments (the highest since April 2020) and December filings up 21% YoY, the pipeline of consumer distress shows no signs of slowing.