If bankruptcy managers haven’t already, they are about to hear from their staff how the new bankruptcy forms are affecting their work. Beginning December 1st, new bankruptcy filers must use the new forms that were recently released by the U.S. Courts. These forms are quite different than their decade-old predecessors and initially pose an increase in risk to lenders as their staff work to understand the new format and determine where the important bits of data are now kept. On top of that, training has become more complicated because the old forms submitted through November 30th will still be prevalent during the next couple years, so employees will need to know both the old and new forms.

- Lending practices, borrowing trends, and even types of debt have changed quite a bit over the last 10 years and the old forms have been pretty much the same for about a decade.

- The older forms were the same for both individual debtors filing a Chapter 7 or 13 and a large corporation. This meant the older forms were more complicated than a typical debtor’s filing required and led to debtor-side mistakes which cost the court and creditors additional time and effort to correct.

- About 10% of all non-business cases from October 1, 2014 through September 30th, 2015 were filed without an attorney. According the IRS, in 2014, 44% of electronic tax filings were self-prepared. Although different, the two types of filings can be thought of as similar and the courts would like to allow debtors more freedom to file without an attorney. The new forms are meant to be easier for the layperson to understand and fill out and are available as electronically fillable PDFs.

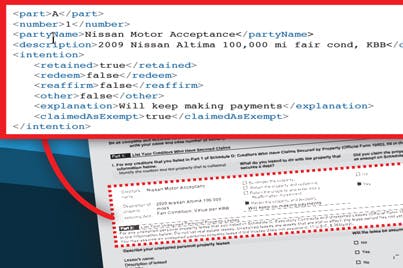

The new bankruptcy forms are meant to be easier for the debtor to understand and fill out. Naturally, this means that there needs to be more paperwork to fill out. The old Voluntary Petition was typically 3 pages. The new forms are 7 pages long. A typical individual bankruptcy filing that includes all statements and schedules will be around 70 pages where it used to be around 50. Lenders can expect their employees to need more time to sift through the paperwork as they encounter more of the new forms.

If the Court is correct and easier forms actually mean more Pro Se debtors, lenders can expect to adjust their policies regarding Pro Se debtors or risk reducing their pool of acceptable candidates. Certainly, if Pro Se filings may increase, we can also expect to see issues arise outside of the initial filing. Debtors often have tasks they need to perform well after their bankruptcy is discharged. Increased Pro Se filings will almost certainly impact the cost of writing and servicing bankruptcy loans.

Lenders are at a point where they need to decide whether to invest in re-training and maintaining their staff’s knowledge or finding new ways of dealing with the amount of data that is required to make sound bankruptcy lending decisions. It makes sense that many will choose to train employees because until recently, there wasn’t another real alternative. As lenders make their decisions and pour months of training and lots of money into these new forms, may I suggest that there is an electronic alternative which should be brought to the table.