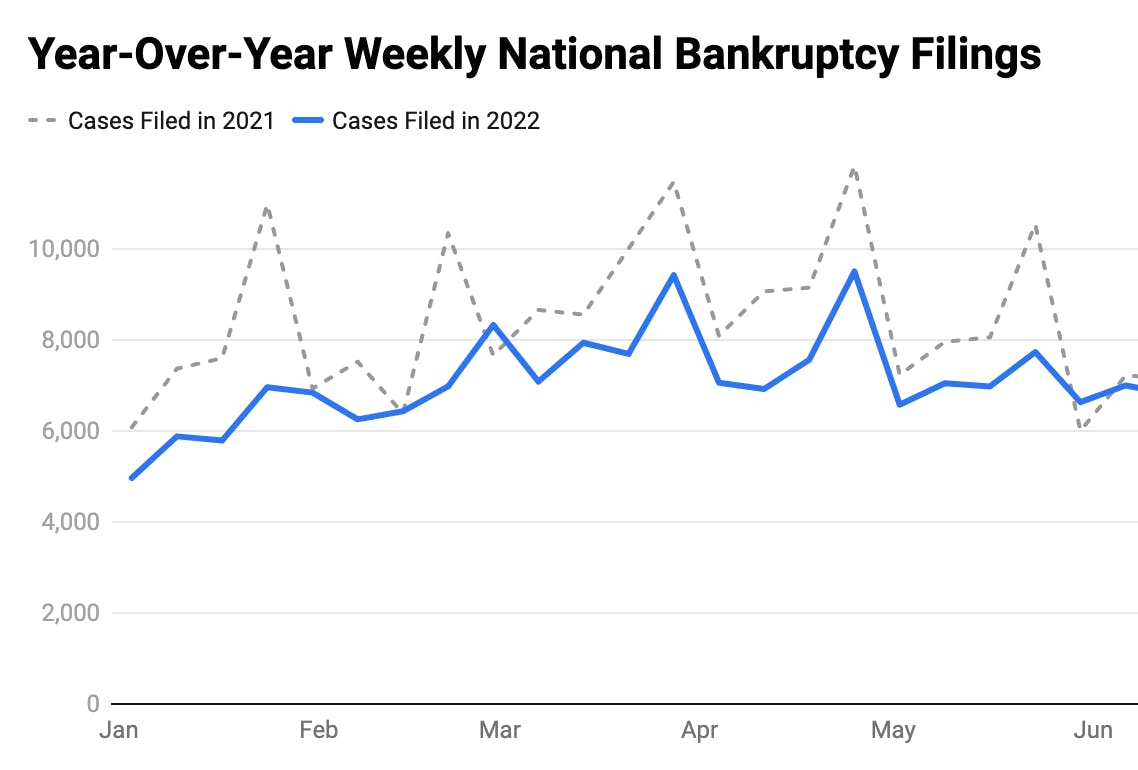

Our annual bankruptcy recap is here! With data on 378,095 cases filed in 2022, there are a lot of interesting trends. Let's jump into the data to provide insight into the most memorable bankruptcy events, highlight some interesting statistics, and reveal the latest innovations in the bankruptcy space.

No Bankruptcy Storm Yet

Bankruptcies ground to a halt during the pandemic, with fewer bankruptcy filings than at any time since the Great Depression. The drop in filings defied predictions by economists who had expected an avalanche of consumer and business filings. Stimulus checks put money in people's pockets, moratoria postponed rent and mortgage payments, unemployment funds provided income to those without a job, low-interest rates kept businesses afloat, and debt relief programs provided repayment plans. Bankruptcy filing numbers still haven't recovered from the pandemic. Overall, 2022 bankruptcy filings were 5.77% below 2021 and 50.0% below 2019 levels. However, there is a marked shift in the type of filing that impacts lenders' ability to recover bankruptcy debt.